Ethanol is the fastest growing corn market.

The IL Corn Growers Association tackles legislative barriers to a growing ethanol market, like moving the E10 tax savings to E15 in Illinois to give consumers an additional financial incentive to fuel up with E15. Additionally, ICGA is working diligently for the passage of Next Generation Fuels Ac, which would allow ethanol to be an important part of a new fuel standard, and for expanded ethanol trade.

The IL Corn Marketing Board is updating ethanol infrastructure so that when the legislative barriers are removed, we’re ready to fuel up Illinois! ICMB also promotes your fuel through programs with local retailers.

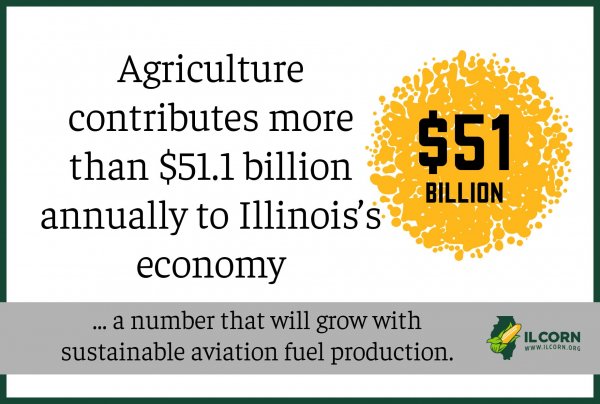

Illinois Uniquely Positioned for SAF Production

Illinois is uniquely positioned to lead the world in decarbonizing the aviation sector. The Land of Lincoln is home to the feedstock, geology, production capability, airlines, and tax credits...

MoreAccess to Higher Blends of Ethanol During Summer Months a Win for Illinoisans

Upon hearing the U.S. EPA announcement that it will issue a temporary waiver allowing access to lower-cost, lower-emission E15, the IL Corn Growers Association President Dave Rylander from...

MoreFrom Fields to Flight: IL Corn Plays Role in SAF Conference

Seeds are being sown to position Illinois as a hub for sustainable aviation fuel (SAF). On March 21-22, IL Corn and the Illinois Manufacturing Association hosted the inaugural Sustainable...

MoreIL Corn Growers Association Responds to EPA Final Tailpipe Emissions Rule

The U.S. Environmental Protection Agency finalized their Tailpipe Emissions Rule last week, making the rule even a bit more stringent than originally proposed. IL Corn joined several groups in...

MoreInaugural Sustainable Aviation Fuel Conference Highlights Opportunity for Renewable Fuel to Lower Emissions and Transform Industries

Inaugural conference will discuss latest in scientific research, production, and logistics The Illinois Manufacturers’ Association (IMA), in partnership with Intersect Illinois and the IL...

MoreNew EPA Rule Ignores Ethanol as a Solution and Threatens Rural Economies

The Environmental Protection Agency (EPA) today announced their final climate rule on vehicle emissions standards for sedans and light- and medium-duty trucks. While this rule is supposed to...

MoreCoalition of Business, Labor, Agriculture Groups Unveil Landmark Legislation to Advance Carbon Capture and Storage in Illinois

IL Corn represents farmer members in discussions to promote ethanol market development and protect landowner rights A coalition of business, labor and agriculture groups have united behind...

MorePolicymakers Must Take a Broader Approach to Reducing Tailpipe Emissions

America is in pursuit of a clean energy future, but to get there, our leaders must prioritize a solution that already exists at gas stations across the country. Ethanol, made from corn...

MoreWhite House to Greenlight Year-Round E15 Availability by 2025: Midwest Governors' Request Answered, Promising Environmental and Economic Benefits

The White House announced today that it will answer the April 2022 request of Governor Pritzker and seven other Midwest governors to make E15 available year round starting in 2025. E15 is a 15...

MorePut the BRAKES on HB1634

This week, Illinois state lawmakers tried hitting the gas to incorporate California’s extreme vehicle emissions standards into the Midwest. HB1634 allows California to govern Illinois Vehicle...

MoreIL Corn Thanks Lawmakers for Support of GREET

Seven members of Illinois’s congressional delegation joined a group of 43 lawmakers in a letter to the Sustainable Aviation Fuels Lifecycle Analysis Interagency Working Group voicing their support...

MoreBipartisan Victory: Next Generation Fuels Act Gains Traction as a Solution Lowering Carbon Emissions Nationwide

The IL Corn Growers Association and the ethanol industry have their foot on the petal in full support of the Next Generation Fuels Act in 2024. The bill, which sets a new clean fuel standard,...

MoreICGA Pleased with Acceptance of GREET; Looks to Monitor Changes

The U.S. Department of Treasury announced today that it will allow a modified version of the GREET model as a measurement for determining reductions in greenhouse gas emissions as the agency...

MoreQ&A: Farmers thoughts on CCS

This fall, IL Corn teamed up with Illinois ethanol plants to host informational sessions highlighting the connection between carbon and corn production. Lauren Lurkins, an environmental law...

MoreIllinois Corn Farmers Recognize Illinois Senator Joyce

Illinois State Senator Patrick Joyce received the ethanol award from the IL Corn Growers Association (ICGA) at the group’s annual meeting on November 21, 2023, in Bloomington. Senator Joyce...

MoreAirlines Show Support for Ethanol Industry

Airlines Show Support for Ethanol Industry The IL Corn Growers Association (ICGA) commends the airline industry for their support of the U.S. Department of Energy’s Argonne GREET model...

MoreICGA offers NHTSA “Fuel for Thought”

The IL Corn Growers Association (ICGA) helped magnify the voice of rural Americans, sharing over 900 comments opposing the National Highway Traffic Safety Administration’s electric vehicle...

MoreNCERC Hosts Group of Indian Leaders on Trade Mission

National Corn-to-Ethanol Research Center (NCERC) hosted a team of 10 executives from India’s automotive, biofuels and automotive sectors. The team, brought here through a U.S. Grains Council Trade...

MoreGovernor J.B Pritzker Talks with Commodity Groups at Farm Progress Show

Cameras, carts and security details created quite a buzz at the commodity tent IL Corn Growers Association members spoke with Governor Pritzker at Farm Progress Show about policy impacting...

MoreNHTSA on a "one-way" route towards EV Future

The IL Corn Growers Association is calling on the agricultural industry to submit comments to the docket regarding a proposal released by the National Highway Transportation Safety Administration...

More