TAIWAN IMPORTS MOST U.S. CORN IN SEVEN YEARS, PLEDGES MORE DURING GOODWILL MISSION

Lindsay Mitchell

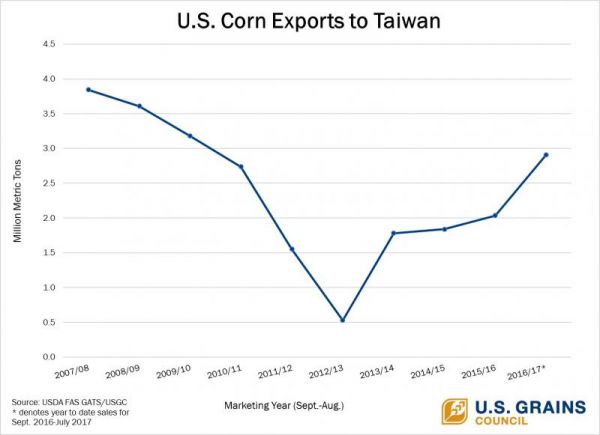

U.S. corn captured 89 percent of Taiwan corn imports in the 2016/2017 marketing year (September-June), up dramatically from 28 percent the same time period the year prior. With 2.91 million tons (114.5 million bushels) sold from September 2016 to July 2017, these sales are the highest in the last seven marketing years, making Taiwan the fifth largest market for U.S. corn.

The United States also accounts for 95 percent of the DDGS imported by Taiwan. Almost all large feed mills in Taiwan currently utilize DDGS, but typically at extremely conservative inclusion rates. After working with the U.S. Grains Council to understand how to optimize caloric and nutritional efficiency using DDGS, Taiwan purchased nearly 240,000 tons of U.S. DDGS thus far in the 2016/2017 marketing year, a 23 percent increase year-over-year.

“The Council works to help improve efficiency in Taiwan’s domestic meat, milk and egg production, instill confidence in U.S. feed grains and co-products and ensure no disruption in the trade between the two countries.” “The Council has worked in Taiwan for more than four decades as part of a long-term effort to secure market share and food security through trade,” said Clover Chang, the U.S. Grains Council's (USGC's) director in Taiwan.

Taiwan imports nearly all of its local feed demand, primarily for swine and poultry. In the 1990s, Taiwan imported more than 6 million tons (236 million bushels) of corn per year. However, a disease in 1997 caused a steep decline in pork production and feed grain demand. Corn imports rebounded as the market recovered, as did U.S. corn market share until drought conditions in 2012 limited supplies and spurred competition from countries like Brazil.